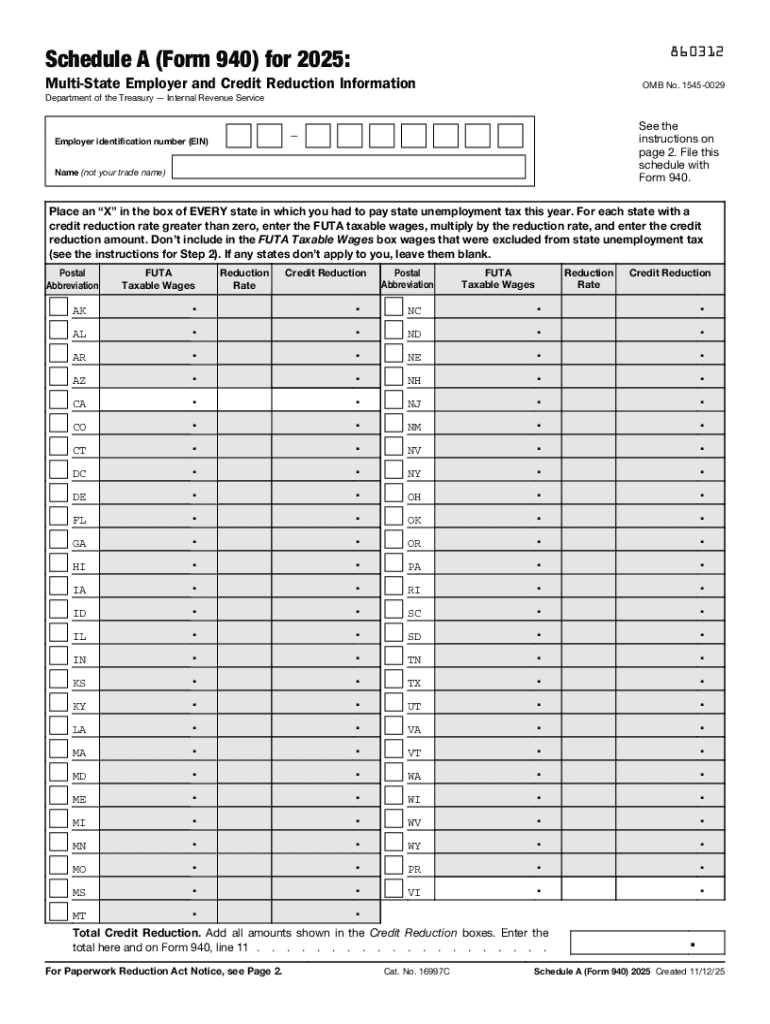

IRS 940 - Schedule A 2025-2026 free printable template

Instructions and Help about IRS 940 - Schedule A

How to edit IRS 940 - Schedule A

How to fill out IRS 940 - Schedule A

Latest updates to IRS 940 - Schedule A

All You Need to Know About IRS 940 - Schedule A

What is IRS 940 - Schedule A?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 940 - Schedule A

What should I do if I realize I made a mistake on my IRS 940 - Schedule A?

If you discover an error on your IRS 940 - Schedule A, you should file an amended return using Form 940-X. Clearly indicate the corrections needed and submit it along with any supporting documentation to ensure clarity and accuracy. This will help avoid penalties and ensure that your records are accurate.

How can I verify the status of my IRS 940 - Schedule A submission?

To verify the status of your IRS 940 - Schedule A, you can use the IRS 'Where's My Refund?' tool or call the IRS directly. Keep in mind that common e-file rejection codes can also assist in identifying issues if your submission was not accepted. It's important to act promptly to resolve any discrepancies.

What are the data privacy measures I should consider when filing the IRS 940 - Schedule A electronically?

When filing the IRS 940 - Schedule A electronically, ensure that you use secure methods to protect sensitive data. Look for e-file providers that comply with IRS security standards and offer data encryption. It’s also essential to understand your obligations regarding record retention to safeguard your information.

How can I handle filing an IRS 940 - Schedule A on behalf of someone else?

If you need to file an IRS 940 - Schedule A on behalf of someone else, ensure that you obtain proper authorization through a Power of Attorney (POA) form. This establishes your legal right to act on their behalf and is essential for compliance with IRS regulations.

What should I do if I receive a notice from the IRS regarding my IRS 940 - Schedule A?

If you receive a notice from the IRS about your IRS 940 - Schedule A, carefully read the letter to understand the issue raised. Gather any required documentation and respond promptly, addressing the concerns outlined in the notice to avoid further complications.

See what our users say